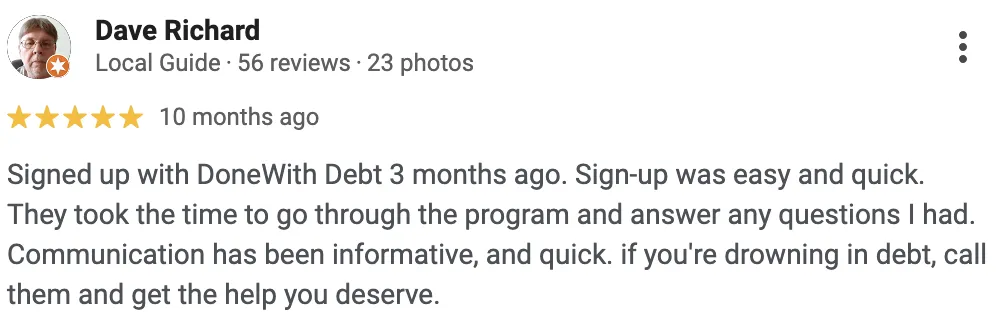

Trusted by 100,000+ Clients

4.8 - 304+ Reviews

4.8 - 39+ Reviews

4.8 - 304+ Reviews

4.8 - 39+ Reviews

How It Works

You’re in control, we do the heavy lifting to get you debt-free.

Talk to us for a free consultation

Share your story, and we’ll uncover your best path to freedom, no pressure, no upfront fees.

We build a plan that fits your life

A payment plan designed around your budget, so you can breathe easier every month.

Debt-free in as little as 24 months

Stop drowning in interest. Start living without debt sooner than you think.

Why Work With Us?

Over 10 years helping people break free from debt and take back their life.

Professional Support That Cares

You’re not just a number. Your certified debt specialist will listen, understand your unique situation, and create a plan built just for you so you never have to face this alone.

Zero Upfront Fees

We don’t get paid until you see results. That means our success is tied to your success.

24/7 Progress Tracking

Day or night, you can log in to your secure portal and see exactly where you stand, every step toward your debt-free future.

Frequently Asked Questions

1: What types of debt qualify for this program?

We work with unsecured debt such as credit card balances, personal loans, and private student loans. These are the most common types we help people reduce and restructure.

2: What types of debt do not qualify?

We cannot work with secured debts like mortgages, car loans, or business loans. If most of your debt is secured, this program likely isn’t the right fit.

3: How much debt do I need to qualify?

Most of our successful clients come in with $30,000 or more in unsecured debt. This ensures there’s enough room for creditors to negotiate meaningful savings.

4: Is there a minimum income requirement?

Yes. To stay on track, you’ll need at least $3,000 per month in gross income. This allows creditors to see a realistic path to repayment and ensures you can succeed in the program.

5: What if I don’t meet these requirements?

If you’re slightly below the debt or income thresholds, it may still be worth speaking with one of our specialists. They can walk you through options and point you in the right direction if this program isn’t the best fit.

6: Will applying hurt my credit?

No. Getting qualified and learning about your options will not affect your credit score.

©2025. Done With Debt, LLC. All Rights Reserved. | Terms & Conditions